FINTECH SOLUTIONS

Mobile-first approach to customer engagement for daily banking and insurance

by MONDRIAAN

FINTECH SOLUTIONS

Mobile-first approach to customer engagement for daily banking and insurance

by MONDRIAAN

Work with MONDRIAAN ON

Omnichannel customer acquisition

Personalized brand experience to deliver the right message to the right customer

Fast time to market

Rapid prototyping with MONDRIAAN’s platforms, SDKs and its proven Product Discovery Sprint

Bank-level security

Secure customer banking app or website engagement ensured by notification encryption and on-premises operation

Work with MONDRIAAN ON

Omnichannel customer acquisition

Personalized brand experience to deliver the right message to the right customer

Fast time to market

Rapid prototyping with MONDRIAAN’s platforms, SDKs and its proven Product Discovery Sprint

Bank-level security

Secure customer banking app or website engagement ensured by notification encryption and on-premises operation

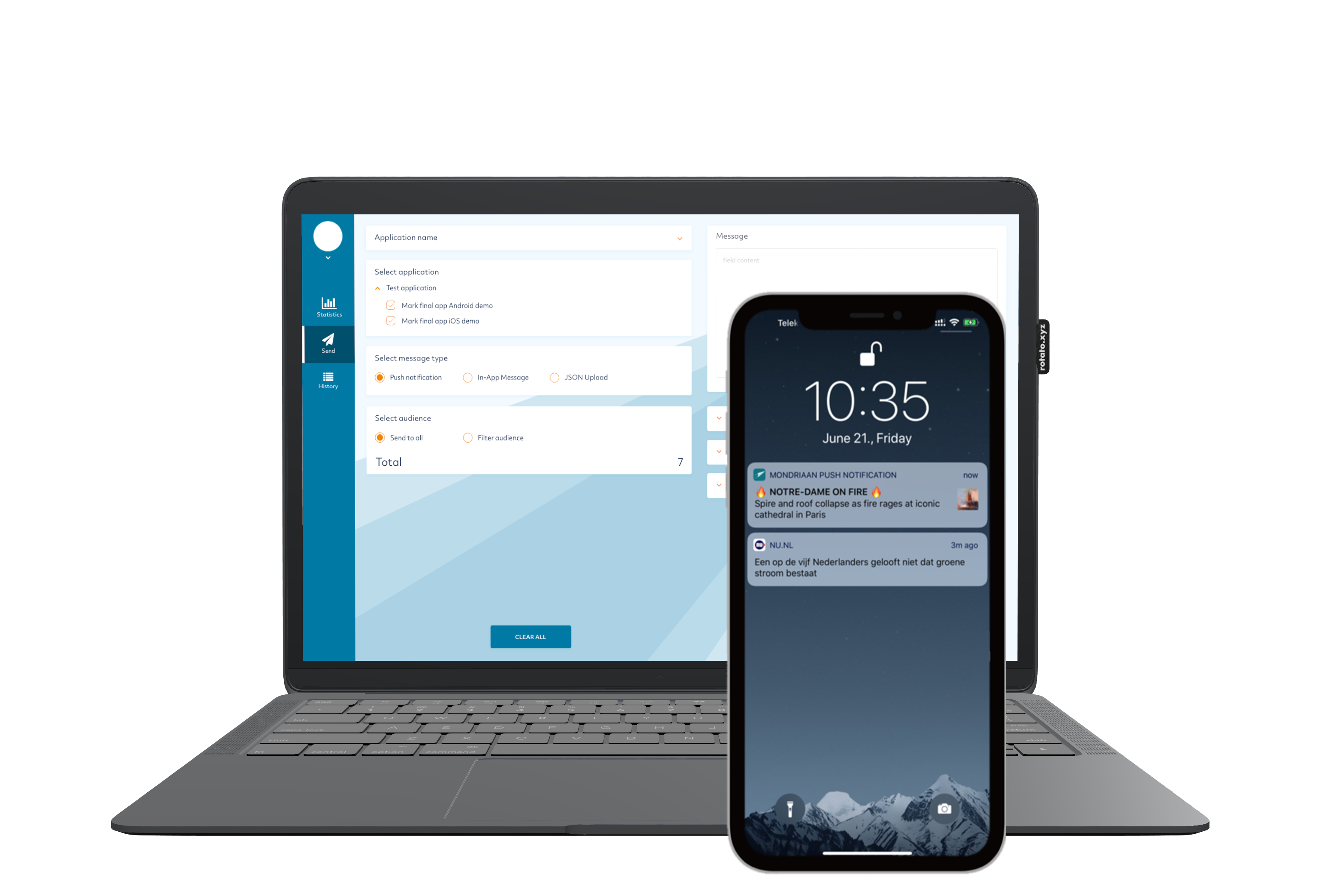

Secure push notifications

Bank and insurance institute

Problem

Engaging with customers via SMS has high cost per message and does not offer sophisticated targeting options that could leverage existing CRM data.

Answer

MONDRIAAN introduced an encrypted messaging platform that is capable of on-premises operation . It is currently in use to send 450 million messages a month on average.

Solution

Thanks to MONDRIAAN’s secure Pushwize platform banks can now send personalised push messages to the targeted segment and provide transaction information at the friction of the SMS cost.

Capable of end-to-end message encryption, login is protected by two factor authentication, and PSD2 required Moblie Strong Customer Authentication (SCA) without having Google or Apple to oversee the messages.

Results

The platform leverages the existing abundance of the banks’ customer data and connects to CRM systems to engage with clients based on predefined triggers.

Personalized and secure engagement built on top of financial IT infrastructure.

Contribution

User research | UX&UI design | iOS application | Android application | back-end development

Secure push notifications

Bank and insurance institute

Problem

Engaging with customers via SMS has high cost per message and does not offer sophisticated targeting options that could leverage existing CRM data.

Answer

MONDRIAAN introduced an encrypted messaging platform that is capable of on-premises operation . It is currently in use to send 450 million messages a month on average.

Solution

Thanks to MONDRIAAN’s secure Pushwize platform banks can now send personalised push messages to the targeted segment and provide transaction information at the friction of the SMS cost.

Capable of end-to-end message encryption, login is protected by two factor authentication, and PSD2 required Moblie Strong Customer Authentication (SCA) without having Google or Apple to oversee the messages.

Results

The platform leverages the existing abundance of the banks’ customer data and connects to CRM systems to engage with clients based on predefined triggers.

Personalized and secure engagement built on top of financial IT infrastructure.

Contribution

User research | UX&UI design | iOS application | Android application | back-end development

Klink! Transaction-based reward platform

K&H (KBC Hungary affiliate)

Problem

Open banking poses new challenges to banks on how to position themselves in the platform economy.

Answer

MONDRIAAN developed a transaction-based reward platform that leverages banks’ core competences and combines them with proven customer engagement solutions.

Solution

The K&H Innovathon’s award-winning Klink! platform was developed to enable financial institutes to connect their business and retail clients in a multi-sided ecosystem. Customers receive rewards based on the purchasing behaviour, businesses get higher conversions, while banks can engage with new clients.

Results

“…MONDRIAAN’s solution is unequivocally the solution of the future…” K&H board member

Contribution

User research | UX&UI design | iOS development

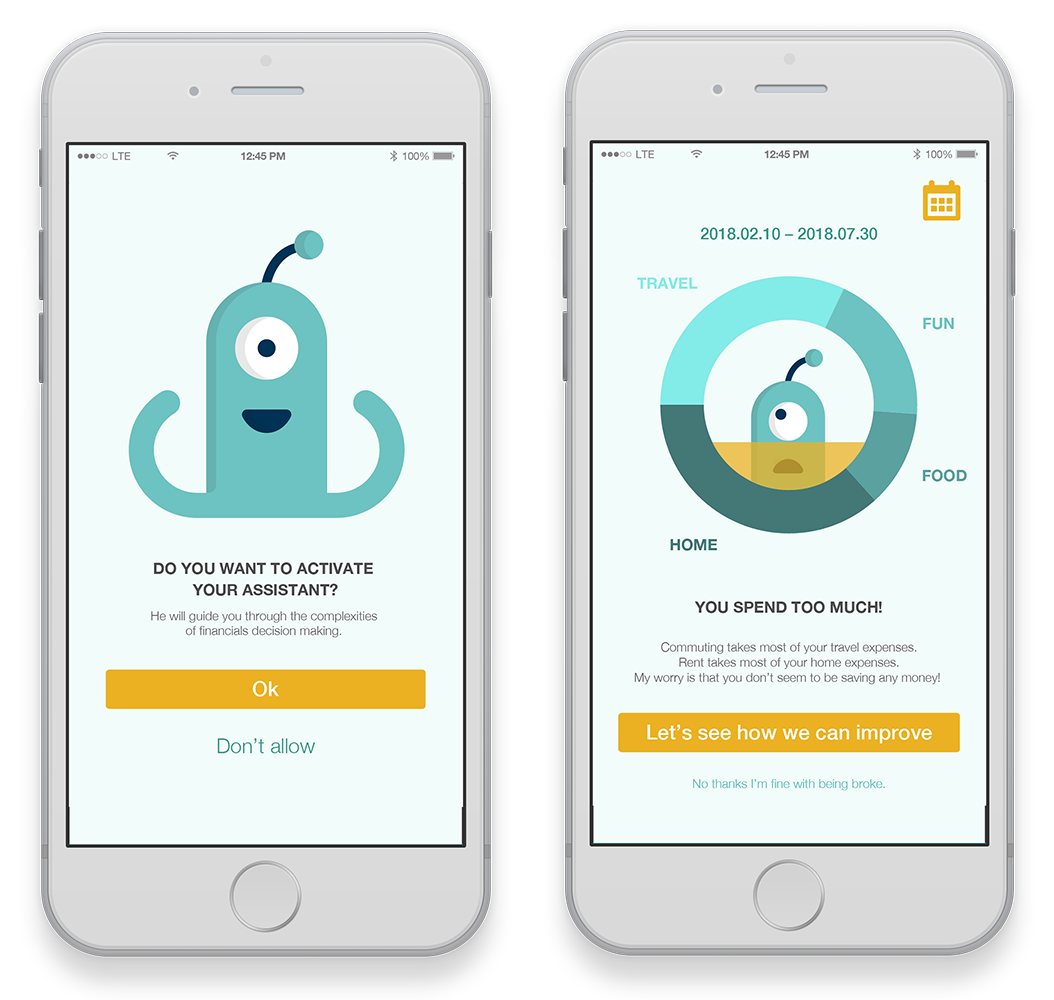

Emotional banking for Gen.Z

Financial institute in CEE

Problem

The digital native, Generation Z. is entering the financial market, however traditional customer acquisition is not entirely successful within this age group.

Answer

MONDRIAAN’s approach was the usage of emotional triggers to onboard teenagers to financials institutes.

Solution

The proven MONDRIAAN digital prototyping method was used to design, validate and develop an MVP.

MoneyQuest is a Machine learning-based Personal Finance Management solution that helps young clients to gain financial literacy and reach their goals with personalised saving and spending options.

Results

The Product Discovery sprint has validated an improved way of customer acquisition for banks in an untapped segment.

Contribution

User research | UX&UI design | iOS development

Klink! Transaction-based reward platform

K&H (KBC Hungary affiliate)

Problem

Open banking poses new challenges to banks on how to position themselves in the platform economy.

Answer

MONDRIAAN developed a transaction-based reward platform that leverages banks’ core competences and combines them with proven customer engagement solutions.

Solution

The K&H Innovathon’s award-winning Klink! platform was developed to enable financial institutes to connect their business and retail clients in a multi-sided ecosystem. Customers receive rewards based on the purchasing behaviour, businesses get higher conversions, while banks can engage with new clients.

Results

“…MONDRIAAN’s solution is unequivocally the solution of the future…” K&H board member

Contribution

User research | UX&UI design | iOS development

Emotional banking for Gen.Z

Financial institute in CEE

Problem

The digital native, Generation Z. is entering the financial market, however traditional customer acquisition is not entirely successful within this age group.

Answer

MONDRIAAN’s approach was the usage of emotional triggers to onboard teenagers to financials institutes.

Solution

The proven MONDRIAAN digital prototyping method was used to design, validate and develop an MVP.

MoneyQuest is a Machine learning-based Personal Finance Management solution that helps young clients to gain financial literacy and reach their goals with personalised saving and spending options.

Results

The Product Discovery sprint has validated an improved way of customer acquisition for banks in an untapped segment.

Contribution

User research | UX&UI design | iOS development

Solve banking challenges with MONDRIAAN competences

Enhanced customer engagement

Seamless user experience delivered in lifestyle, media, news and ecommerce

open banking

Experience in multiple PSD2 APIs and AISPs and building solutions on existing infrastructure

Platformization

Develop and operate international platforms that serve millions of European users

MONDRIAAN enables banks to perform personalized interactions with their clients

Solve banking challenges with MONDRIAAN competences

Enhanced customer engagement

Seamless user experience delivered in lifestyle, media, news and ecommerce

Open banking

Experience in multiple PSD2 APIs and AISPs and building solutions on existing infrastructure

Platformization

Develop and operate international platforms that serve millions of European users

MONDRIAAN enables banks to perform personalized interactions with their clients

CONTACT US

1023 Budapest

Ürömi utca 43

Industries

Blog

CONTACT US

1023 Budapest

Ürömi utca 43

Industries